It’s the time of year where tax preparations begin. The following reports are available in My Food Program and may be helpful for tax preparation. These reports are used most often by family child care homes. Click each report image below to visit our Help Center article for more details.

See more: Reports for Parents | Income Reports | Expense Reports

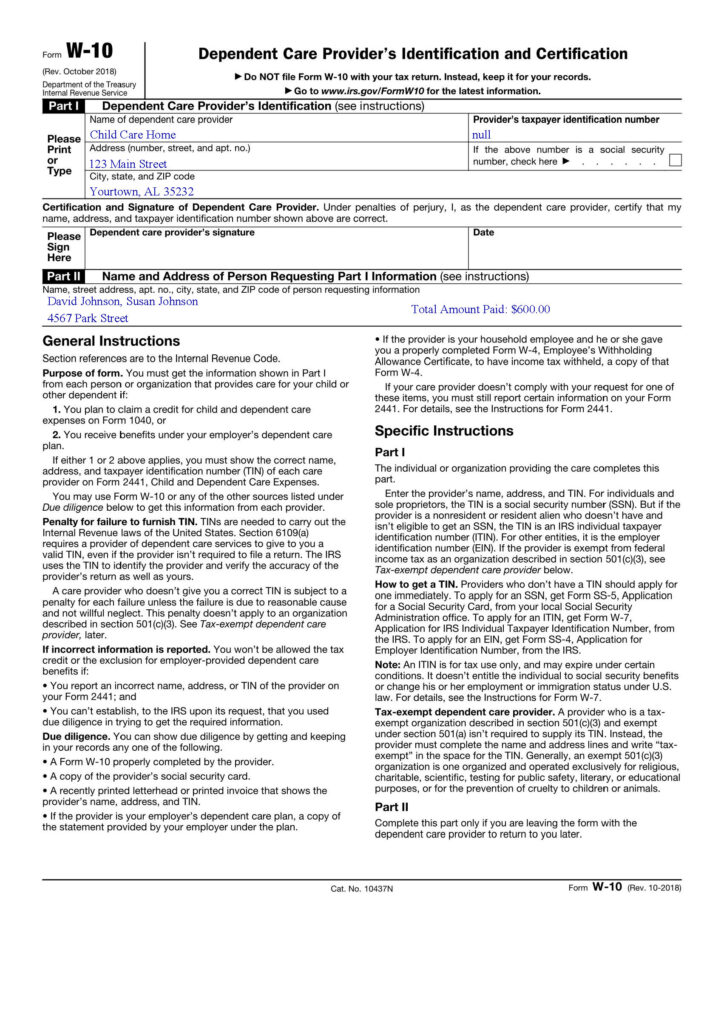

REPORTS FOR PARENTS

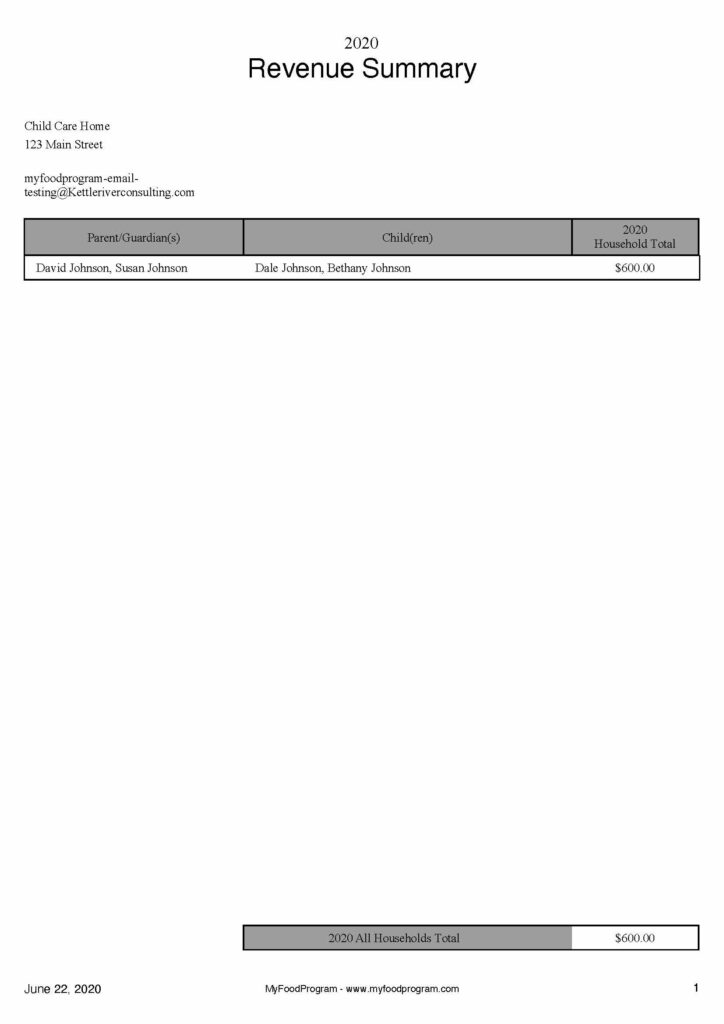

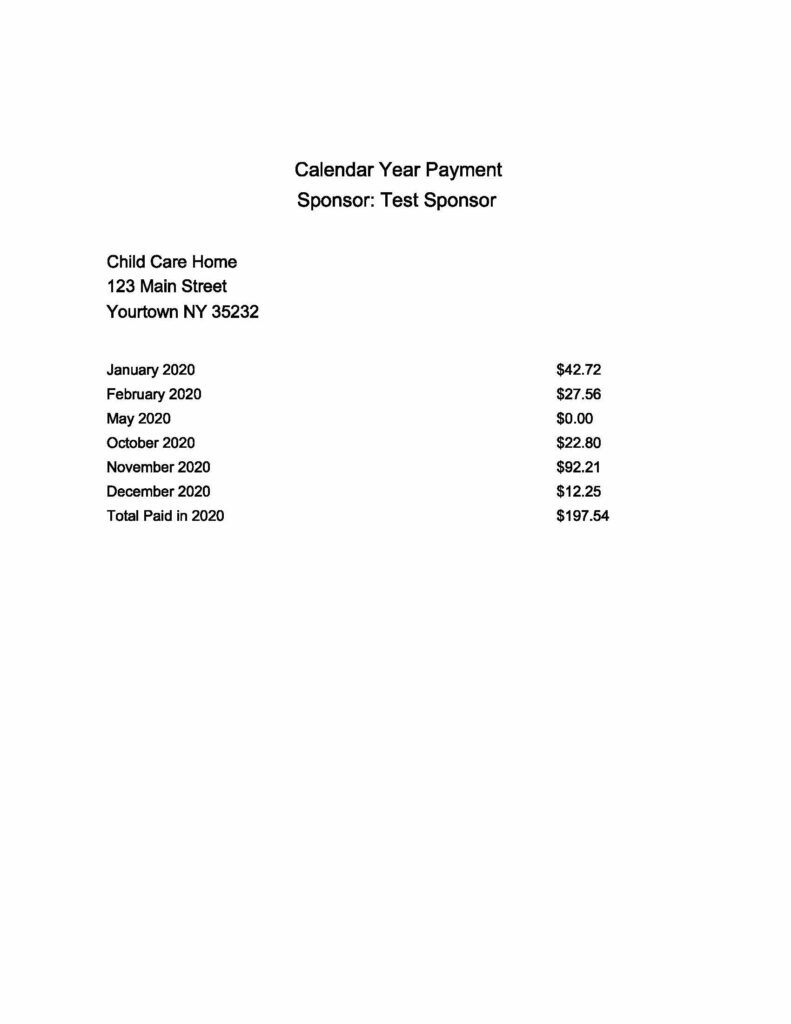

INCOME REPORTS

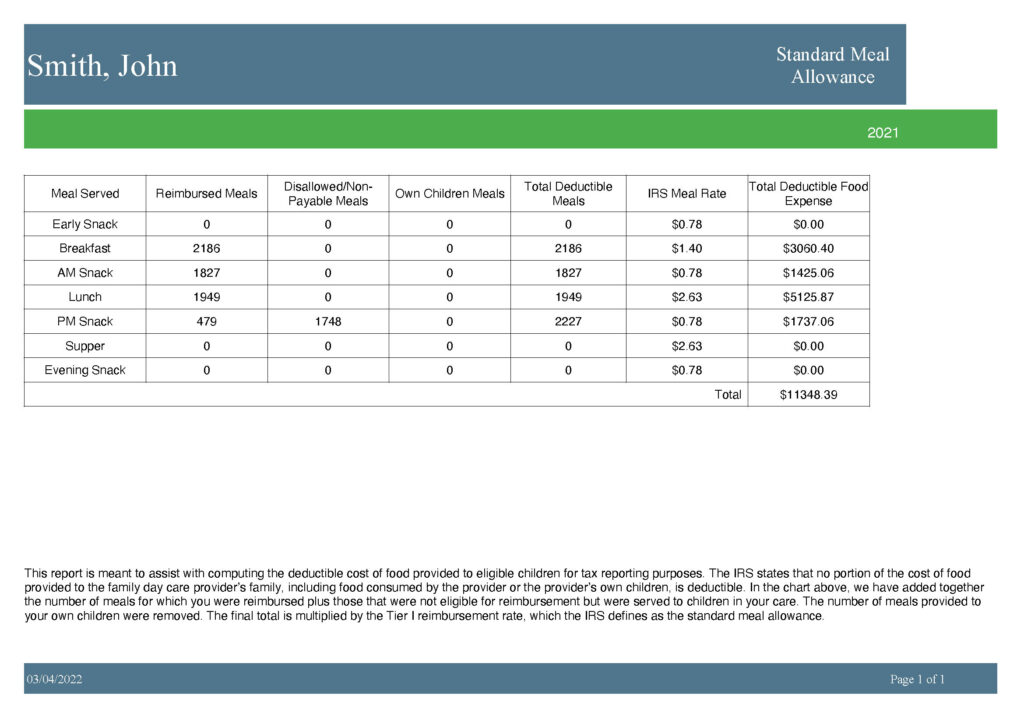

Note: the Standard Meal Allowance Report will not match the Payments by Calendar Year Report since the CACFP operates on a reimbursement basis. Learn more in our Help Center article.

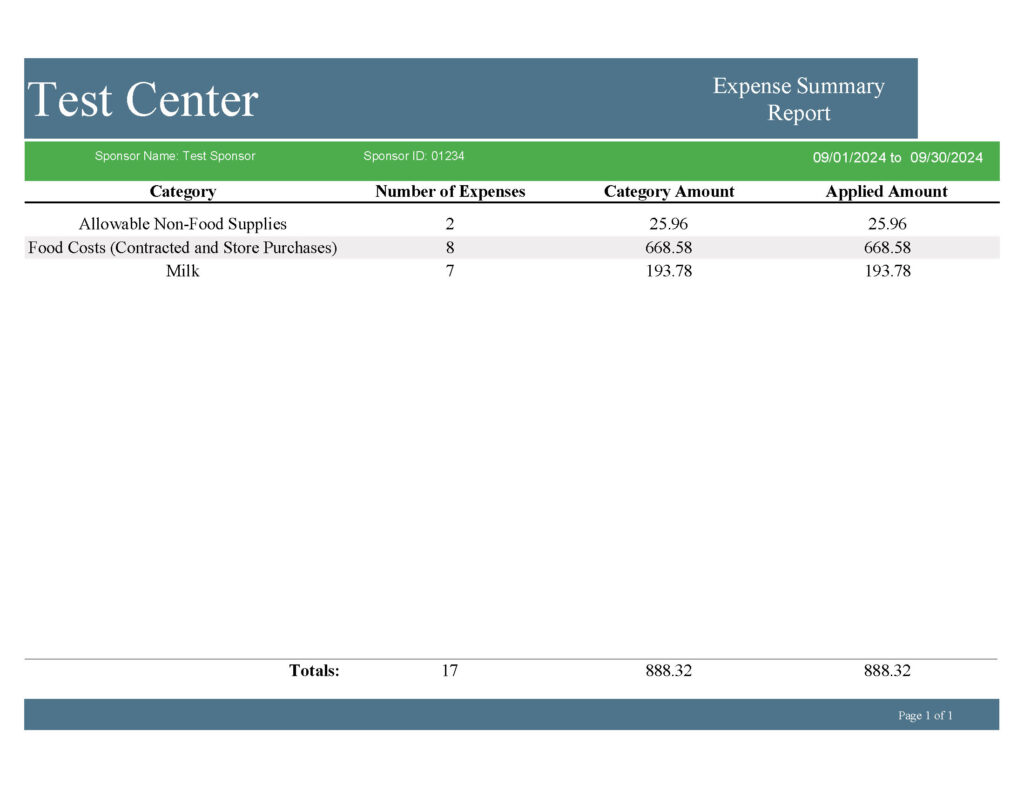

EXPENSE REPORTS

From Providing Food:

Standard Meal Allowance

Family child care providers can deduct all of the costs of providing food to the children in their care on their taxes on IRS Form 1040 Schedule C in Part V. This report uses the standard meal allowance method, which adds up all the meals and snacks that you served to the children in your care, takes away any meals served to your own children, and multiplies the totals by the Tier I rate.